Cramer’s Bumpy Ride With Lululemon: Balancing Big Wins and Big Worries

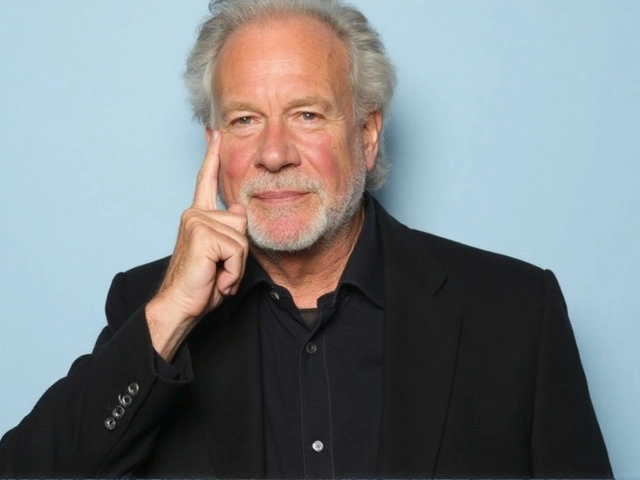

Few Wall Street personalities draw as much attention with their stock picks as Jim Cramer, and his take on Lululemon hasn’t exactly been straightforward lately. One day he’s pointing out the yoga-wear giant’s bargain price tag, the next he’s drilling into weak company guidance. For everyday investors trying to make sense of LULU’s roller-coaster moves, Cramer’s evolving commentary reads like a playbook for both confidence and caution.

Earlier this year, Cramer’s optimism seemed a bit muted after Lululemon dropped its quarterly numbers for Q4 2024. The numbers weren’t bad on the surface: revenue jumped to $3.61 billion, beating the market’s expectations, and profits topped out at $6.14 per share. But it was the outlook that rattled investors—the company projected Q1 sales between $2.335 and $2.355 billion, lower than Wall Street’s $2.39 billion consensus. Shares took an instant 10% hit in after-hours trading. Cramer went on air saying he couldn’t quite understand the upbeat tone from management given those warnings about the current quarter.

Yet, in typical fashion, Cramer’s analysis didn’t stick in one place. He quickly changed gears as international numbers rolled in and the headlines shifted. Lululemon’s sales outside North America jumped an eye-popping 38% year-over-year, powered largely by a surge in China and other Asian markets. In the same period, sales in the Americas grew by a modest 7%. Despite rising inventory—now at $1.4 billion—the company ended the quarter with a healthy $2 billion in cash. Most retailers can only dream about that kind of financial cushion, especially in a tough market.

Tariffs, Chinese Growth, and Analyst Headaches

Tariffs on Vietnamese imports suddenly became a key wild card. Lululemon’s stock price had been limping after fears that trade barriers would put a dent in margins. But the mood turned when U.S. officials hit the brakes on new tariffs in the summer of 2025. The stock recovered more than 9%, a move Cramer flagged as proof that panic was premature. He stuck to his guns, insisting that Lululemon was trading below its true worth—especially given how well its Chinese business was performing. But he also warned that future tariff decisions could flip the story yet again.

The debate around LULU didn’t stop with TV punditry. Wall Street’s own experts couldn’t make up their minds either. Oppenheimer’s analysts shot for the stars, slapping a $500 price target on the stock. Jefferies, meanwhile, kept things more cautious. The mixed sentiment reflected real tension: Lululemon was growing overseas and sitting on a pile of cash, but inventories were rising at the same time as North American growth slowed. For every bull cheering the company’s international domination, there was a bear pointing to softer guidance and warning that the rebound might not last if trade winds shifted again.

If Cramer’s fluctuating analysis shows anything, it’s how even the most experienced voices can struggle to pin down a stock like Lululemon. One quarter brings warning signs, the next brings a recovery driven entirely by overseas shoppers and shifting trade policy. For investors used to steady narratives, LULU’s journey is a reminder: even giants don’t get a smooth ride when tariffs, global demand, and a fickle market are in play.