Wealth Redistribution: What It Is and Why It Counts

When you hear the term wealth redistribution, think of the idea that money or assets move from richer people or groups to poorer ones. It isn’t about taking everything away; it’s about making sure basic needs are met and chances are fair.

Governments use taxes, benefits, and public services to shift resources. The goal is to reduce gaps that can cause social tension, health problems, or lower economic growth. In plain terms, it’s a way to share the pie so everyone gets a slice.

How Wealth Redistribution Happens

The most common tool is the tax system. Progressive taxes mean higher earners pay a larger share of their income. That money then funds schools, hospitals, and welfare programs that help lower‑income families.

Another tool is direct cash transfers. Programs like unemployment benefits or child allowances give money straight to people who need it. These payments can boost spending, keep families afloat, and reduce poverty.

Public services are also a form of redistribution. Free or low‑cost education, healthcare, and public transport let everyone use resources that would otherwise be expensive.

Sometimes governments intervene in markets. Minimum wage laws, price controls, or subsidies for housing and food make essential goods more affordable for everyone.

Common Debates and Real‑World Examples

People argue about how much redistribution is right. Some say too much can discourage hard work and entrepreneurship. Others believe that without enough sharing, societies become divided and unstable.

Look at the Nordic countries. They have high taxes but also low poverty, good schools, and strong health systems. Many point to them as examples of successful redistribution.

In the United States, debates focus on tax brackets, college tuition, and social security. Proposals for a wealth tax or higher marginal rates often spark heated discussion.

During crises, redistribution becomes especially visible. Emergency stimulus checks, rent relief, and food aid after natural disasters show how quickly resources can be moved to where they’re needed most.

At the local level, cities may offer affordable housing vouchers or community grants. These programs aim to balance opportunities within neighborhoods.

Understanding the basics helps you see why headlines about tax reform or welfare changes matter to everyday life. It’s not just politics; it’s about the services you use and the safety net you rely on.

If you’re curious about how a specific policy works, check the details: the tax rate, the eligibility rules, and where the money goes. That will tell you whether it truly helps the people it’s meant to reach.

In short, wealth redistribution is a set of tools that move money from those who have more to those who have less. It aims to create a fairer society where everyone can meet basic needs and plan for the future.

Whether you support more redistribution or less, knowing the facts lets you join the conversation with confidence.

Kieran Lockhart, Jul, 25 2025

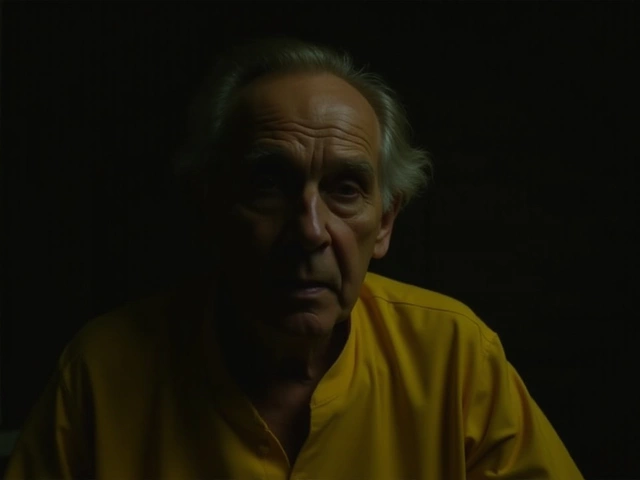

Jeremy Corbyn Unveils Radical Left-Wing Party Pushing for Wealth Redistribution

Jeremy Corbyn and Zarah Sultana have launched a new left-wing political party in the UK, promising direct action on wealth redistribution, nationalizing industries, and supporting social causes. With explosive sign-up rates and big policy plans, the party, known for now as 'Your Party,' could shake up future elections.

View More